Understanding your credit rating

Read our explanations and advice on how to manage your credit rating.

4 factors considered when requesting a loan

- Your debt ratio (you may evaluate it on your own by clicking on Debt Ratio);

- Your credit score Equifax/TransUnion;

- The stability of your income and the length of time with your current employer;

- Your credit rating for various loans (example : R1, R3 etc.);

- Job stability.

Advice to improve your credit score

- Before applying for a loan, arrange to obtain a copy of your credit report from the credit agencies and review them to ensure that there are no errors. Should there be an error, you should make the correction immediately. A well prepared credit application with a reasonable amount requested, properly presented at your financial institution will reduce the chances of a refusal and avoid a negative note in your credit file.

- Avoid repeated credit loan applications. Rejected loan applications negatively impact your credit score.

- Before scheduling a meeting at your financial institution, you should calculate your “Debt Ratio” to make sure you are an acceptable range (i.e. between 0%-40%). If you exceed 40%, the loan application will likely be rejected, and this rejection will negatively affect your credit rating. You might want to discuss the situation with your financial institution manager before making the official loan request.

- Avoid paying your accounts late. Whether the unpaid amount is small or large, a delay is a delay. An R-9 credit rating is frowned upon by your creditors, whether the outstanding amount is $2000 or $200.

- Try to maintain your credit card and line of credit balances as low as possible, ideally 25% or less of the authorized limit. It is at this percentage that your credit score increases the most. Should the balance be more than 50% of the authorized limit, there can be a negative impact on your credit score.

- The accounts (credit card / line of credit / personal loan) that have been opened for the longest period of time better serve your credit score than newly opened accounts. If possible, keep them open, without having too many of them opened at the same time.

- Beware of any advertisement that guarantees a quick solution to better your credit rating and score. Fees can be very high and there are no magical solutions. As in a healing process, time and patience are the best remedies to regain the confidence of your creditors.

- Aside from a pre-paid credit card, during the first two years of your bankruptcy, avoid any loan application with any financial institution that was included in your bankruptcy or proposal. Since they incurred a loss, they are likely to be less willing to offer you any credit.

- Avoid the pitfalls of debt. You have learned to live without credit during your bankruptcy or proposal. You would be wise to preserve any borrowing capacity for the purchase of a car or house, rather than spending on non-essentials such as: furniture, travel, renovations, spas, etc.

- Finally, keep in mind that just because a financial institution offers you credit does not mean that it’s a good idea to accept it.

Definition credit scores

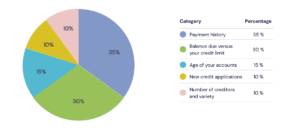

5 factors that influence your score

- Payment history (35%)

Any delay of thirty (30) days or more will be noted in your file and will negatively affect your score. The longer the delays, the greater the damage will be. Avoid delays at all cost! Note that even if you fully reimburse a balance that was late, it will leave traces in your credit file for… 6 years! - Balance due versus your credit limit (30%)

An average of over 50% of the authorized credit will negatively affect your score, even if you pay the total balance at the end of every month. Ideally, you should maintain a balance of less than 35% of the authorized limit. For example, no more than $3,500 for a $10,000 limit. That said, be careful because a higher credit limit increases debt risk.. - Age of your accounts (15%)

Old accounts allow your creditors to more easily assess your repayment habits. Thus, the longer the history, the better your score will be. The score takes into account your oldest account plus the average age of all your accounts. Keep your oldest account active and avoid opening too many new ones. - New credit applications (10%)

Each time a lender checks your credit report to grant you a loan or credit card, a note is written in your file and will stay there for 3 years. If you are searching for credit, creditors will think that you are more likely to get into debt which is not a good thing. Knowing this, avoid multiple credit requests and avoid filling out credit card applications for “a chance to win a trip”. - Number of creditors and variety (10%)

Creditors believe that the more creditors you have, the more you increase your risk of becoming indebted. You should therefore limit the number of new accounts, especially if they are same type of credit (ex.: credit cards). That being said, for the purposes of your score, it is good to have a variety in the type of credit. For example, having multiple credit cards can hurt your score whereas if you have, instead, a credit card, a line of credit and a credit card of another type (ex.: department store), this can help your score.

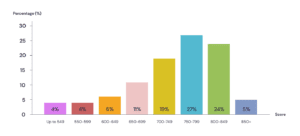

Nationwide distribution of scores

By way of illustration, we have prepared below a graphic distribution, by score, of people that have a credit file at Equifax Canada:

(source : equifax.ca)

Definition

in the case of an open line of credit, the preceding letter will be an “O”.

To obtain your credit file

By law and upon request, you have the right to obtain a copy of your credit score and report. You can obtain a copy free of charge, by becoming a member at www.Equifax.ca

You can also obtain your TransUnion credit file, free or charge, by becoming a member at www.TransUnion.ca.

Free access now includes your score, which will give you the overall assessment score for your file.

To verify your credit file

Once you have received your Equifax and TransUnion credit reports, we encourage you to verify the accuracy of the information listed in your credit reports. For example, you will find the information that should be visible following a bankruptcy and a consumer proposal.

To correct your credit file

Equifax and TransUnion are obligated under the law to post information that properly reflect reality. Therefore, if you notice a mistake and fie a request for correction, they must investigate and correct any such mistake.

Equifax

You must first complete the Consumer Credit Report Update Form.

Once completed, you can:

- Call Equifax at 1-800-465-7166 between 8:00 am and 5:00 pm EST

- Send the form by fax at 514-355-8502

- Or mail them your form at:

Equifax Canada Co. Consumer Relations Department

C.P. 190

Montreal (Québec), H1S 2Z2

Website Equifax

Equifax will verify the necessary information and mail you a confirmation. Equifax will review any new details you provide and compare it to the information in our files. If our initial review does not resolve the problem, we will contact the source of the information to verify its accuracy. If the source informs us that the information is incorrect or incomplete, they will send Equifax updated information and we will change our file accordingly. If the source confirms that the information is correct, we will not make any change to our file. In either case, you may add a statement to our file explaining any concerns you have. Equifax will include your statement on all future credit reports we prepare if it contains 400 characters or less.

If Equifax changes our file in response to your request, we will automatically send you an updated credit report to show you the changes. At your request, we will also send an updated credit report to any of our customers who received one within 60 days before the change was made.

TransUnion

You must first complete the Investigation Request Form.

Once completed, you can:

- Call TransUnion 1 877 713-3393 between 8h30 AM and 5h00 PM EST

- Or, write to:

TransUnion, Consumer Relations Department

3115, Harvester Road, Suite 201

Burlington (Ontario) L7N 3N8

Website TransUnion

Our debt solutions

Based on your situation and needs, there are different solutions that can help you regain your financial stability.

Debt Consolidation

Find out how to merge all your payments into one monthly installment and keep your credit score intact.

Consumer Proposal

Discover how to offer your creditors a lower settlement based on your ability to repay.

Personal Bankruptcy

Discover how personal bankruptcy can put an end to your financial difficulties and debt problems.