How to check your Equifax and TransUnion credit reports?

Step 2: Verification of the accuracy of your information in your credit reports

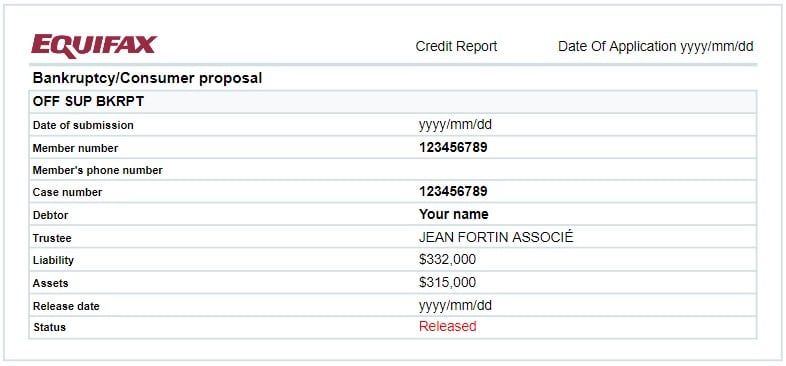

Equifax:

-

From your Equifax online account, in the “Public Records” section, please ensure that your bankruptcy record shows the status as “Discharged”.

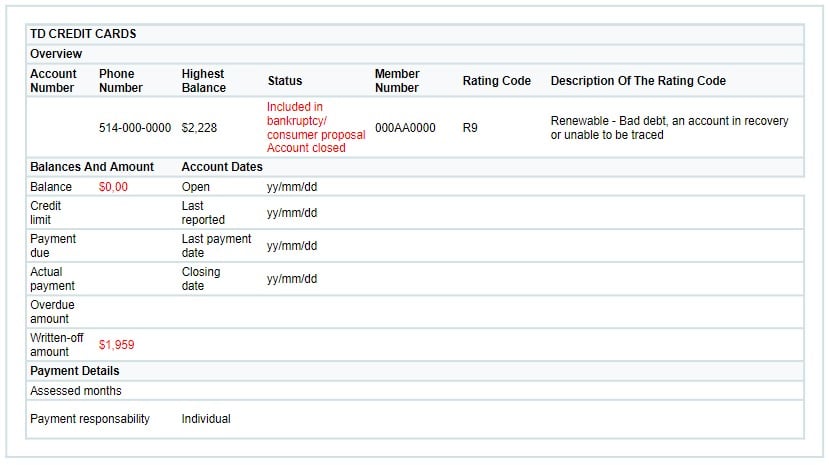

- Each of your debts from your creditors included in your insolvability should:

- Have the status “Included in Bankruptcy/Account Closed”.

- Have a balance of $0.

- Have an amount written off.

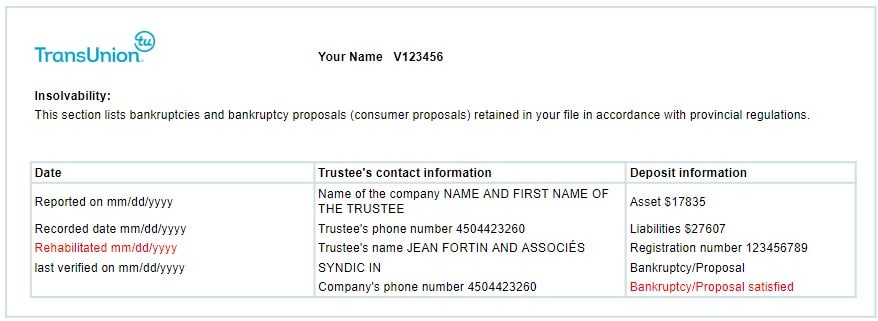

TransUnion:

- From your TransUnion online account, in the “Date” section, please ensure that your bankruptcy record states “Rehabilitated on (date of your discharge)”.

- In the “Deposit Information” section, please ensure that your bankruptcy/proposal states “Satisfied”.

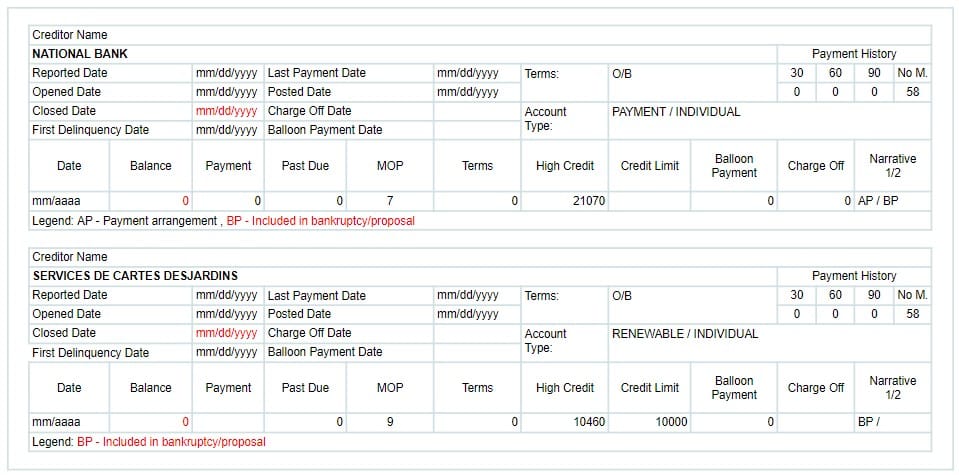

- Each of your debts from your creditors included in your insolvency should:

- Have a “Closure Date”.

- Have a balance of $0.

- Have the mention “Included in Bankruptcy/Proposal” in the “Legend” section.

Please note that if all the information is correctly indicated in your Equifax and TransUnion credit reports, no further action is required. However, if any errors are visible, follow the instructions mentioned in Step 3 of this document to correct the inaccurate information in your credit reports.

Step 3: Correction of inaccurate information in your credit reports

Under the law, credit bureaus are obligated to present accurate information. Therefore, if you notice an error, they must correct it if you provide them with the documents below, including the requested supporting evidence.

Equifax:

Please duly fill out and print the credit report dispute form.

Please mail it along with 2 pieces of identification, your discharge certificate, and your complaint register to the address provided on the form. Alternatively, you can fill out a credit report dispute online, but you will need to combine all your documents into a single PDF. If needed, you can call them at 1-800-465-7166. You will receive a postal letter informing you of the update to your Equifax file.

TransUnion:

Please duly fill out and print the investigation request form.

Please mail it along with 2 pieces of identification, your discharge certificate, and your complaint register to the address provided on the form. If needed, you can call them at 1-800-663-9980. You will receive a postal letter informing you of the update to your TransUnion file.

See also...

Understanding Your Credit Rating

Get advice and tips on how to adopt healthy habits and improve your credit rating.

Balance Your Budget

Track your spending in order to successfully manage your financial priorities.

What are the risks of a high debt ratio?

The professionals at Jean Fortin inform you about the signs and consequences associated with high levels of debt.