Consumer Proposal

Discover how to offer your creditors a lower settlement based on your ability to repay.

What is a Consumer Proposal?

A consumer proposal is an agreement that your trustee negotiates with your existing creditors to reduce the amount to be repaid. The new monthly payment will be based on your financial capacity rather than the total amount of your debt plus interest. Unlike a debt consolidation, you are not obligated to repay 100% of your debts. Furthermore, since the law states that the interest rate for a consumer proposal is 0%, on an offer of $20,000, for example, you would save a minimum of $6,700 in interest compared to a debt consolidation loan.

Creditors are generally open to such agreements as long as they are convinced of your good faith, your ability to meet the new promised amount, and that the proposal offers them a higher amount than what they could expect to receive if you were to declare bankruptcy.

Why file a consumer proposal?

Payment reduction: If your financial situation justifies it, you are not obligated to repay 100% of your debts. Additionally, the interest rate on your unsecured debts (personal loans, credit cards, lines of credit, etc.) is automatically limited to 0%, significantly reducing the monthly amount you will have to pay.

Easier to manage: All debts are consolidated into a single payment that you make to the trustee, making it easier to manage your finances and reducing the risk of payment defaults. Furthermore, the trustee acts as the intermediary between you and your creditors and is responsible for negotiating (and all communications) with them.

Majority vote: A simple majority of your creditors is sufficient for all creditors to be bound by the proposal. Therefore, there is no need to convince each individual creditor. Additionally, if creditors do not respond within the 45-day period they have to vote following the filing of your proposal, they are presumed to have accepted the proposal.

Protection and peace of mind: A consumer proposal provides protection from your creditors, allowing you to breathe easier. Once your proposal is filed by the trustee, all collection actions, including calls and seizures (with rare exceptions), will cease. The trustee will handle all communication with your creditors.

Your assets: You have the choice to keep the assets you want, such as your house and car, and surrender to your creditors those you no longer wish to keep. For example, if your car is too expensive for your budget or you prefer not to keep it, you can surrender it to the creditor, and any loss they incur will be included in your proposal.

How much should I offer to my creditors?

After analyzing your financial situation (assets, debts and budget), your advisor at Jean Fortin will help you determine a reasonable amount for the creditors that you can afford. It is a combination of the value of your assets and the amount you have available each month for your creditors that will determine the amount and duration of your proposal offer. Your advisor will be responsible for presenting this offer to your creditors and negotiating with them, if necessary.

Who can administer a consumer proposal?

Only licensed insolvency trustees, such as the professionals at Jean Fortin, are authorized to file a consumer proposal. We are experts in personal finance and can help you choose the best option.

If a consumer proposal is determined to be the best solution for you, it will be prepared and negotiated by your trustee. It is also to your trustee that you will make the monthly payment as agreed upon, and who will distribute the funds to your creditors.

Once your proposal is filed, you are protected by law, and all communication with your creditors will be handled by your advisor at Jean Fortin.

The consumer proposal is a good option for you if...

- You are able to repay at least part of your debts.

- You have already filed for bankruptcy before and you want to avoid the inconveniences of a 2nd bankruptcy.

- You have assets that are worth substantially more than the amounts owed to your secured creditors.

- You want to avoid bankruptcy for reasons other than financial.

- You are a professional or have a license and you do not want to be affected by bankruptcy.

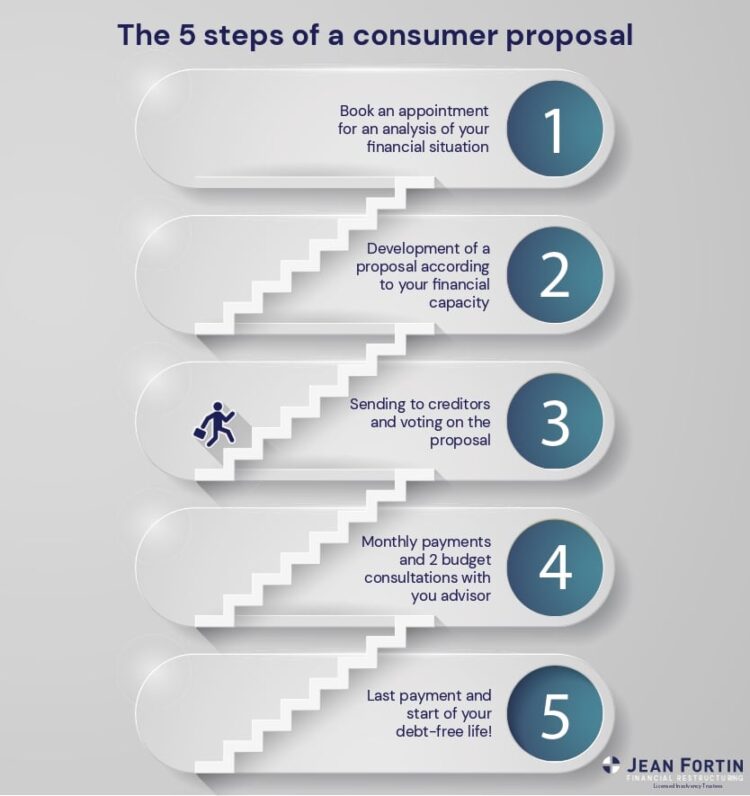

The 5 steps of a consumer proposal:

- Schedule an appointment with one of our personal finance advisors for a review of your financial situation. This is an opportunity to ask questions and learn about all possible options available to you.

- Based on the recommendations of your advisor, we will prepare a proposal with monthly payments that are in tune with your financial capacity.

- Filing of your proposal, distribution to the creditors, and final vote on the proposal on the 45th day.

- Begin making your monthly payments and have 2 budget consultations with your advisor.

- Upon making the final payment, your proposal is completed, and you can start your debt-free life!

Differences between consumer proposal and bankruptcy

Sometimes, the financial advantages and disadvantages of these 2 options are quite similar, making your decision even harder. If you’re unsure which of the 2 options is best for you and you are wondering about the differences between bankruptcy and a consumer proposal, we invite you to read our articles At any time, please feel free to consult with one of our advisors. He or she will take the time to have an open and honest discussion with you to help make the best choice, free of charge and with no obligation.

Once you all well-informed, the final decision will then depend on factors that are more personal and aligned with your values.

The impact of a consumer proposal on your credit report

1st stage: In the context of a consumer proposal, the credit rating associated with each debt included in your proposal will be R-9. Debts that you continue to pay, such as your car loan or mortgage, will have a rating of R-1 (or M-1) if you remain up to date with those payments.

2nd stage: Once your proposal is fully paid, the debts included in it are «discharged», meaning that creditors cannot demand repayment from you anymore. The credit rating for each of these debts will increase to R-7, the balance owed on them will be reduced to zero, and with no more debts, your credit file begins to recover more rapidly.

3rd stage: The mention of your consumer proposal and the debts included in it will be permanently removed from your credit report 3 years after the completion of the proposal or 6 years after it was filed, whichever comes first. Therefore, if it takes you 5 years to pay off your proposal, it will be removed the following year.

Better than doing nothing

While it is true that a consumer proposal has a negative impact on your credit report, often, when people are heavily in debt, their credit is already tarnished. In such cases, the proposal is not the problem but rather the solution, as the most damaging factors for a credit report are payment delinquencies and excessive debt.

Undeniable advantages

A consumer proposal allows you to consolidate your debts into a single payment, eliminates all interest charges, and reduces, in most cases, the total amount of debts to be repaid. Often, it is the only way to balance your budget and regain control of your debt. And that is what your creditors will appreciate. Therefore, the impact of a consumer proposal on your credit report should be evaluated in the medium and long term, particularly in relation to your overall financial well-being.

Recently Accepted Proposals

| Client | Debts | Proposal | Savings (including interest) |

Creditors |

|---|---|---|---|---|

| #1 | $ 40 180 | $ 24 000 | $ 39 540 | NBC-President's Choice, Canadian Tire |

| #2 | $ 28 550 | $ 6 000 | $ 35 300 | Telus, Visa-RBC, BMO, Hydro-Quebec |

| #3 | $ 37 500 | $ 9 000 | $ 44 850 | Canadian Tire, Visa-Desjardins, Scotia Bank |

| #4 | $ 85 200 | $ 51 000 | $ 71 000 | Visa-TD, Scotia Bank, Revenu Quebec, Visa-Desjardins |

| #5 | $ 42 000 | $ 15 000 | $ 34 000 | Canadian Revenue Agency, Revenu Quebec |

Conclusion

If you are struggling to repay 100% of your debts but can offer a reasonable amount to your creditors, a consumer proposal is an excellent alternative to balance your budget and regain your financial freedom.

We invite you to read all our articles on consumer proposals.

Your questions

Am I discharged from all of my debts if I file a consumer proposal?

The law aims to promote your financial rehabilitation and your right to work and rebuild your financial health. Thus, all debts, except for the following debts, are dischargeable at the end of your proposal (section 178 of the Bankruptcy and Insolvency Act):

- Any award of damages by a court in respect of bodily harm intentionally inflicted, or sexual assault, or wrongful death resulting therefrom.

- Any debt or liability for alimony.

- Any debt or liability under an order for the maintenance and support of a spouse or child living apart from the bankrupt.

- Any debt or liability arising out of fraud, embezzlement, misappropriation while acting in a fiduciary capacity.

- Any debt or liability for obtaining property by false pretenses or fraudulent misrepresentation.

- Any liability for the dividend that a creditor would have been entitled to receive on any provable claim not disclosed to the trustee.

- Any debt or obligation in respect of a student loan guaranteed by the government where the date of bankruptcy occurred before the date on which the bankrupt ceased to be a student or within 7 years after the date on which the bankrupt ceased to be student.

- Any debt for interest owed on any of the above noted non-dischargeable debts.

Am I entitled to have or open a bank account?

Under the Act, you have the right to have or open a personal bank account even if:

- You are unemployed.

- You do not have money to deposit in it immediately.

- You have declared bankruptcy.

However, the bank is entitled to refuse to open an account if:

- It believes that you will use the account in an illegal or fraudulent manner.

- You have ever engaged in illegal or fraudulent activity at a bank over the past 7 years.

- You have provided it with misleading information.

- You are unable to present proper identification.

If you are dissatisfied with any decision or action taken by a financial institution, you can file a complaint to the bank’s Ombudsman. Its role is to analyze the situation objectively and make corrections when necessary.

Can a consumer proposal stop legal proceedings including the seizure of my property or the garnishment of my wages?

Declaring a consumer proposal immediately places you under the protection of the law. This means that any seizure or legal proceedings against you are stopped.

However, there are exceptions if one of these 3 situations arises:

- A secured creditor (ex: mortgage or car loan) may initiate or continue recourse if you default on payments under your contract. However, this recourse is limited to repossession of the asset, and the creditor cannot hold you responsible for any monetary loss resulting from the repossession. For example, if you have stopped paying your mortgage or have chosen to return the keys to your car because the monthly payments were too high, the creditor can repossess the asset, but they will not have the option to pursue you afterward for the loss they incurred. However, please note that for such a debt to be included in your proposal or bankruptcy, your intention to abandon the property must be clearly stated in said proposal or bankruptcy.

- Seizure for child support payments you owe will not be suspended.

- If a creditor obtains permission from the court, they may continue their recourse. Rest assured, this scenario occurs very rarely and typically only arises in cases of fraudulent debt.

Can an overpayment of the CERB be included in a consumer proposal?

The Office of the Superintendent of Bankruptcy, an agency of the federal government, has addressed the issue and confirmed that an overpayment of the CERB is a debt that can be included in a consumer proposal (and bankruptcy). However, if the government believes that a person was not eligible to receive the CERB, it may apply to the court to have the debt declared non-included due to false declaration. However, due to the number of cases involved (over 800,000 according to the latest estimates), the costs involved in such an application, and the burden of proof that the government must meet to convince a court that there was a false declaration, such requests are extremely rare and, to date, we have not had any in our files.

Can I file a proposal for certain debts only?

No. if you file a proposal, you do so for all your debts, except for those secured by assets you wish to retain (e.g., your home or your car). However, nothing prevents you (but there is no obligation either) after completing your proposal, from repaying a creditor for a debt you consider “moral”, but be careful not to compromise your financial stability. After a proposal, you should finally be able to breathe easier. Your efforts should rather be directed towards creating an emergency fund to deal with any unforeseen events and saving for your future projects and retirement.

Can I keep a credit card if I file a consumer proposal?

Yes, you are not required to surrender your credit cards to the trustee when you file a consumer proposal. However, if you have an outstanding balance on a credit card or with the financial institution that issued the card, the institution may (and almost always does) cancel it.

Do ALL of my creditors have to agree with my proposal to be accepted?

No. A favorable vote from a simple majority (50% plus one, 1$ = 1 vote) of your creditors is sufficient for all to be automatically bound by it. Therefore, it is not necessary to convince all of them.

However, if a majority of your creditors does not accept your initial proposal, your trustee can negotiate, on your behalf and with your authorization, amendments that would be acceptable to all parties.

How is my credit rating affected if I file a consumer proposal?

For bankruptcy, the credit rating is R-9 for 6 years after your bankruptcy discharge (7 years for TransUnion). For a consumer proposal, the rating is R-9 during the proposal and R-7 as soon as you have been discharged, and it remains on your credit report for 3 years from the discharge date.

However, did you know that the R-9 rating is also recorded in the following circumstances: bad debt, debt placed in collections, moving without leaving a new address? So, you may already have one or more R-9 ratings on your credit report at this time. If that is the case, your credit file might already be affected.

Secondly, a creditor grants new credit based on 4 criteria (all of which must be met):

- A good credit rating (R-1 or R-2) for each debt

- An overall credit score from moderate to high

- A debt-to-income ratio below 40%

- Stable employment.

So, even if you have a good credit score, having debts can make it impossible to obtain new credit.

In these cases, getting rid of debts with a proposal or bankruptcy could allow you to recover more quickly than trying in vain to pay only the minimum payments in the hope of getting by someday.

Furthermore, any negative mention is recorded on the credit bureau for 6 years (from the date of the last mention to the bureau by the creditor), even if you have fully paid off your debts. Thus, if you take 7 years to pay off arrears of a debt, your R-9 rating could remain on the credit bureau for a total of 13 years (7 years to pay + 6 years).

How to determine the cost of a consumer proposal?

The amount of a consumer proposal is based on a combination of several factors that determine your repayment capacity. The amount offered to your creditors is therefore unique to each individual.

We answer this question in detail in our article “How much does a consumer proposal cost?“.

How to make a consumer proposal?

If you are experiencing financial difficulties that lead you to consider the consumer proposal as a solution, here are the steps you will need to follow:

- Book an appointment with us for an evaluation of your financial situation.

- With our help, preparation of a proposal based on your financial capacity.

- Presentation of your proposal to creditors and voting by said creditors.

- If approved, monthly payments and 2 budget consultations with your advisor.

- Final payment and the beginning of your debt-free life!

We invite you to review the 5 steps of the consumer proposal in detail.

If I file a consumer proposal, will I be able to keep all of my assets?

Yes, the consumer proposal will allow you to retain all your assets, such as your house or your vehicle, if that’s what you desire. At the same time, you will be able to reduce your level of debt.

Obviously, for a proposal to be acceptable to your creditors, the amount offered must take into account the net value of your assets and your income. Thus, the higher the value of your assets, the more appealing your offer will need to be for your creditors; the licensed insolvency trustee can advise and guide you through this stage.

That being said, there may be certain assets that you would be happy to part with. Such as a car whose payment weighs too heavily on your budget, or a house whose mortgage is financially suffocating. The same goes for a property where you may have discovered hidden defects, making its resale difficult, if not impossible.

In these circumstances, handing over the keys to the creditor could be a real relief! The loss suffered by the creditor will be included in the amount of the proposal you make to all your creditors, and your budget will be more easily balanced as a result.

If I owe my ex-spouse arrears in alimony payments, are these debts erased in consumer proposal?

You might see your wages garnished despite your consumer proposal to repay the arrears you owe to your spouse. Child support arrears are not debts dischargeable through a consumer proposal. Please consult with your advisor on your specific situation.

If my spouse is paying alimony and goes on proposal, what happens to the alimony obligation?

If your ex-spouse files a consumer proposal, it does not annul their obligation to continue paying you alimony and any arrears owed, if applicable.

What happens if I used my credit cards just before filing a proposal?

It goes without saying that if, just prior to your declaring bankruptcy, you used your credit cards and made purchases knowing full well that the charges would not be paid back, such actions are not acceptable under the Act. In such cases, the Act provides that the creditors may oppose your discharge, or they may ask the court to have you pay additional amounts to the trustee or to have the debt declared non-dischargeable. This last recourse would mean that the debt would have to be paid back after your discharge from your bankruptcy, with interest. This type of behavior is not recommended.

What happens to my student loan if I go proposal?

Student loans are not dischargeable debts through a consumer proposal if these procedures are filed less than 7 years following the completion of your last studies. The completion of your studies is considered by the ministry to be the date when the educational institution certifies that you have ceased studying for the last time.

If you must or decide to declare bankruptcy or file a consumer proposal less than 7 years following the completion of your studies, however, at the expiration of 5 years following the completion of your studies, you can petition the court to be released from this debt. Depending on certain criteria, the court may discharge you from it if deemed appropriate.

We invite you to learn more about student debts.

What is the duration of a consumer proposal?

The duration of a consumer proposal can be up to 60 months. However, this period can be negotiated and adjusted depending on the financial circumstances specific to your situation and can depend on the requirements of the creditors. During the proposal, it is always possible to pay more rapidly if your situation allows it. When possible, that is highly recommended since the credit file will start to get better once the proposal is completed.

We discuss this in detail in our article “How long does a consumer proposal last?“.

What is the impact of a consumer proposal on your spouse?

Your spouse’s proposal does not necessarily affect your situation. The trustee will analyze with you whether you are responsible for one or more debts of your spouse, because in this case, creditors may demand payment from you.

If you have a joint debt, you remain responsible for that debt even if your spouse makes a consumer proposal and does not have to pay it. If you reach an agreement with this creditor by letting them know that you are willing to comply with the agreed payment terms and pay as agreed, your credit file will not be affected by your spouse’s decision to make a consumer proposal.

If you do not have any joint debts, your spouse’s decision to make a proposal does not affect your credit file in any way. Each individual has their own file. Their payment habits and decisions only affect their own.

Will I be allowed to operate my business?

Yes, this disclosure requirement doesn’t exist, except in exceptional cases, if you’re making a proposal. Also, you have the right to be a shareholder and director of an incorporated company even if you’re in a proposal. In fact, this is one of the reasons why a large proportion of businessmen and businesswomen opt for consumer proposals. The restrictions are almost nonexistent.

90% of proposals filed by Jean Fortin & Associés are accepted.

See also...

Personal Bankruptcy

Discover how personal bankruptcy can put an end to your financial difficulties and debt problems.

Loan Payment Calculator

Use the loan calculator to determine the monthly cost of a loan.

Self-employed worker

Other than the lack of work, arrears in income and sales taxes are, in our experience, a self-employed person’s greatest risk.

Talk to one of our personal finance experts

We are happy to answer any questions and help you see things more clearly.

Call Us

Call us toll free—we’re here to listen.

Monday to Thursday from 8:00 am to 8:00 pm and Friday from 8:00 am to 4:00 pm.

Find a Jean Fortin office near you

Identify your nearest Jean Fortin office by region, location or geolocation.

Book an appointment

Complete a short appointment form directly online to contact one of our financial recovery counsellors.