How do I go about making a consumer proposal?

We will explain the steps to follow in order to file a consumer proposal with the help of your financial advisor.

If you are facing financial difficulties that require you to consider a consumer proposal as a solution, here are the steps you will need to follow:

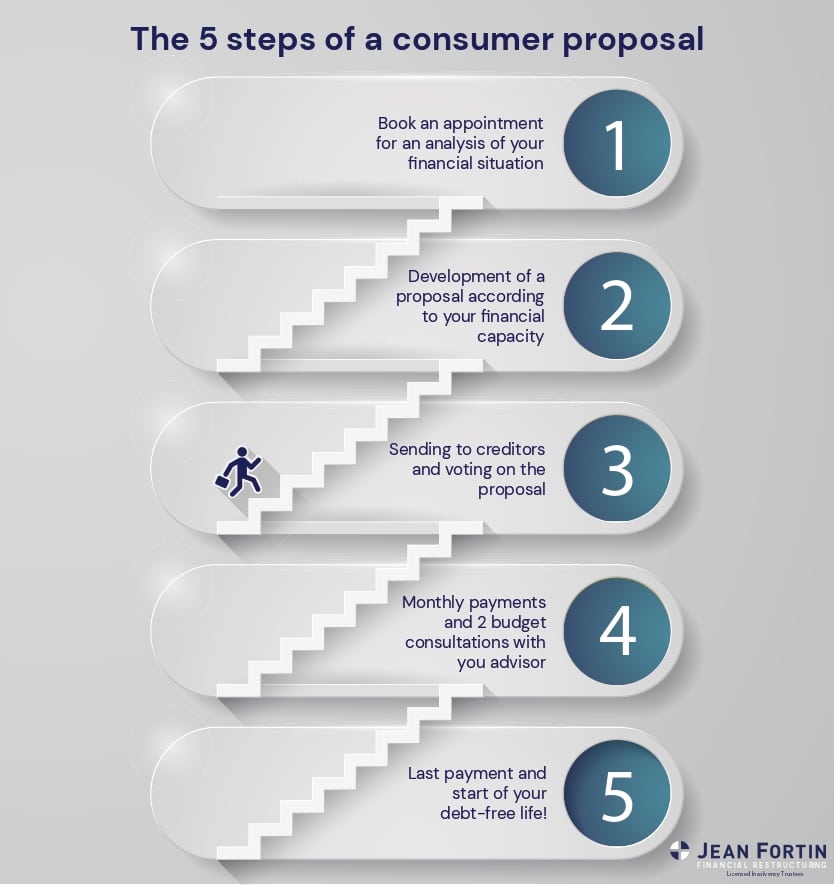

The 5 steps of a consumer proposal:

- Appointment and analysis.

- Preparation of an acceptable offer.

- Filing and acceptance of the proposal.

- Commencement of payments and obligations.

- Start of your debt-free life!

- Appointment and analysis: Click here to make an appointment or call us at 1-877-LIberte for a free consultation, either remotely or in person, depending on your preference.

During our first meeting, we will ask questions and require certain documents to make a thorough assessment of your financial situation. Once this is done, we will discuss possible solutions with you.

- Preparation of an acceptable offer: If the proposal is the best solution, we will review with you what a reasonable offer could be, taking into account your assets, income, and overall financial capacity. Once you have agreed to the proposed terms, we will prepare the necessary documents to place you under the protection of the law and present your proposal to your creditors.

- Filing the proposal: From this point on, you are protected and your creditors will no longer be allowed to contact you, and you will no longer have to make payments on your credit cards, line of credit, personal loan, or tax debt.

Acceptance of your proposal: Creditors have 45 days to accept, refuse, or negotiate the terms of your proposal. All discussions with your creditors will be handled by your personal finance advisor at Jean Fortin. If a majority of your unsecured creditors (50% + 1) accepts your proposal, all your unsecured creditors (including those who voted against your proposal) will be included in your new monthly payment.

- Commencement of payments: Once accepted, you will only need to make the monthly payment promised in your proposal to your trustee, without interest. Although the proposal often allows you up to 60 months to pay the said amount, it is always preferable to pay it off more quickly whenever possible.

Obligations: During the proposal, you will have to have to attend 2 meetings (remotely or in person) with your advisor to help you establish and follow your budget, discuss tips to rebuild your credit, analyze the causes of your financial difficulties to avoid them in the future whenever possible, and answer any questions you may have about the «post-proposal» period.

- The end: When the amount promised in your proposal is fully paid (whether in advance or not), you will be released from all included debts and ready for a fresh start.

You will be proud to have regained control over your finances!

Personal Finance Advisors and Authorized Insolvency Trustees

See also...

Debt Accumulation

We can help you take control of your finances and find solutions that are adapted to your needs.

Consumer Proposal

Discover how to offer your creditors a lower settlement based on your ability to repay.

My first appointment: what can I expect?

Here is what you should expect for your first appointment with a bankruptcy trustee.