How to create a simple and effective budget?

How to establish your personal budget?

First and foremost, a budget should be able to evolve over time; it should be reviewed and adjusted regularly to reflect changes in your income, expenses, and financial goals. Start by establishing clear financial goals, whether it’s paying off your debts, saving for a down payment on a house, or going on vacation. Having specific financial objectives will help you stay motivated and make wise choices.

Main budgetary items

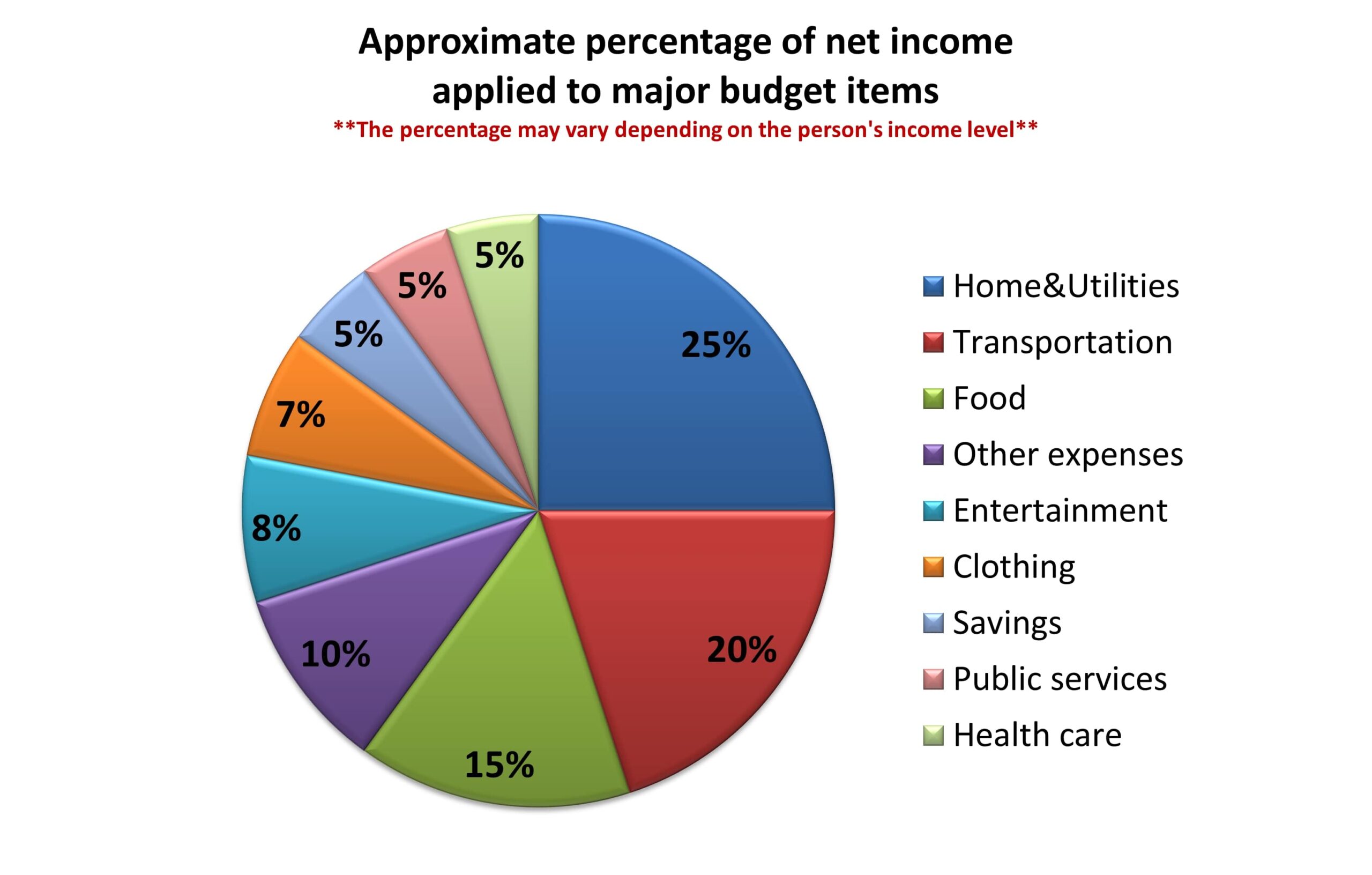

Ideally, the main budgetary items should be distributed as follows (for all budget items, see the diagram below):

- Housing (including rent, mortgage, taxes, heating, and electricity): between 25% and 30%

- Transportation costs: maximum 20%

- Food: between 15% and 18%

- Savings: between 5% and 10%

- Debts: maximum of 15% (monthly payment)

- Leisure: a small amount for this will avoid “budget fatigue” and ensure a better chance of success in the medium and long term.

Where to start?

Start by choosing a budget tool. A computerized tool is essential to allow you to track, categorize and be sure not to forget expenses. Also, depending on whether the expense items are weekly, monthly, or annual, it will do the calculations for you. This will make it easier to simulate scenarios. You can take our online budget tool or choose another one.

A budget comprises 3 types of expenses:

- Fixed

These expenses are easy to establish as they occur every month, are known in advance, and vary very little from one month to the next (e.g., rent, car payment, insurance, etc.). - Variable

These are expenses that occur on a regular basis but vary from month to month (e.g., food, personal expenses, clothing…). Unless these expenses are meticulously noted for at least 2 months, they are difficult to determine accurately. So, start by estimating them, then correct them later with the amounts actually spent. - Irregular

These expenses occur at any time of the year, and the amount is often not known in advance (e.g., car repairs, home maintenance, tires, etc.). They still need to be estimated in advance, and an amount should be set aside every month to create a fund.

Savings are not to be neglected

We saw earlier that you should ideally save at least 10% of your net income. Why? With a view to create:

- Short-term savings

A revolving fund equivalent to 1 month of expenses so as not to have to resort to credit to pay your current expenses. - Medium-term savings

An emergency fund equivalent to 3 months’ salary in case of illness, job loss, urgent repair, etc. This will allow you to be shielded from an unexpected expense without resorting to costly credit. - Long-term savings

A retirement fund (RRSP, TFSA, and RESP).

“Slow and steady always wins the race”: Have a small amount deducted from each paycheck. You will learn to live without this money and save without realizing it.

Involve the entire family

Involve your children/dependents in the development of family budget expenditures, particularly for the section that concerns them (pocket money, vacations, leisure, sports, school supplies, etc.). The exercise will be beneficial for them in the long term and perhaps they will become more aware of the fact that money doesn’t grow on trees!

Be Realistic

Finally, it is essential that your budget is realistic. Establishing a budget that is too restrictive or unattainable can lead to frustration and abandonment.

Typical Budget

Here is an example of a “typical” breakdown of expenses in a budget:

*Note that these percentages are approximate and may vary depending on the size, income level, and lifestyle of the household.

Don’t be shy to ask for advice

A consultation with a personal finance advisor from Jean Fortin or a financial planner could provide guidance and personalized strategies for effectively managing the budget and finances. If you have any questions or need help, do not hesitate to contact our personal finance experts.

It’s free, confidential, and without obligation!

Good luck!

See also...

Financial Health Checkup

The perfect tool to get a quick picture of your financial situation.

Online Budget

Create a budget to track your spending and successfully manage your financial priorities.

Properly planning important expenses

Our advice on how to plan for major expenses while avoiding debt.